Monday, May 8, 2017

- - -

Before last year's PODIM Conference we spoke about the goals and project of the European Investment Plan in financing SMEs and start-ups. What are the results of the program in Slovenia and the EU so far?

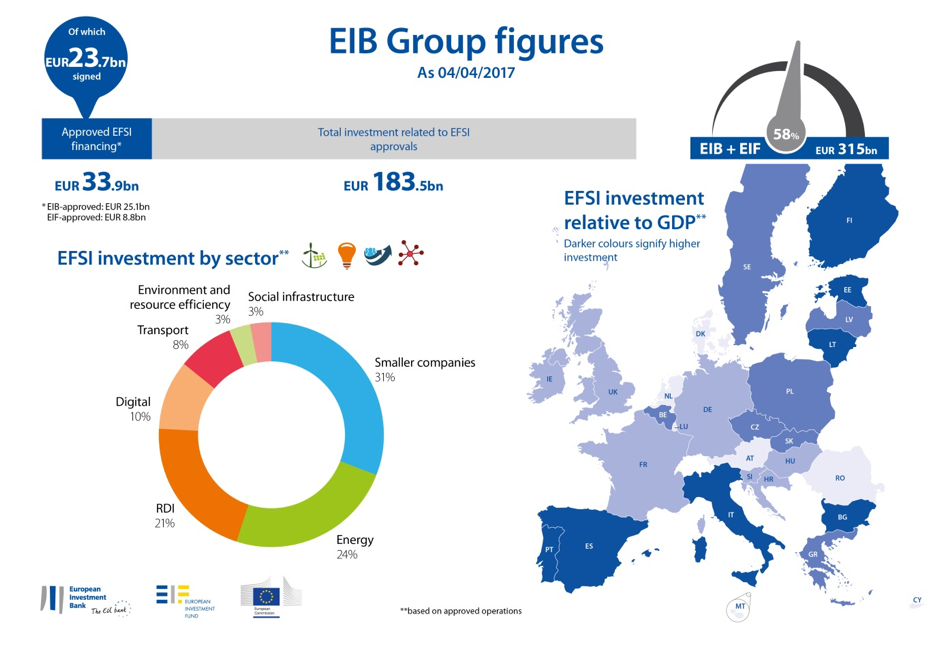

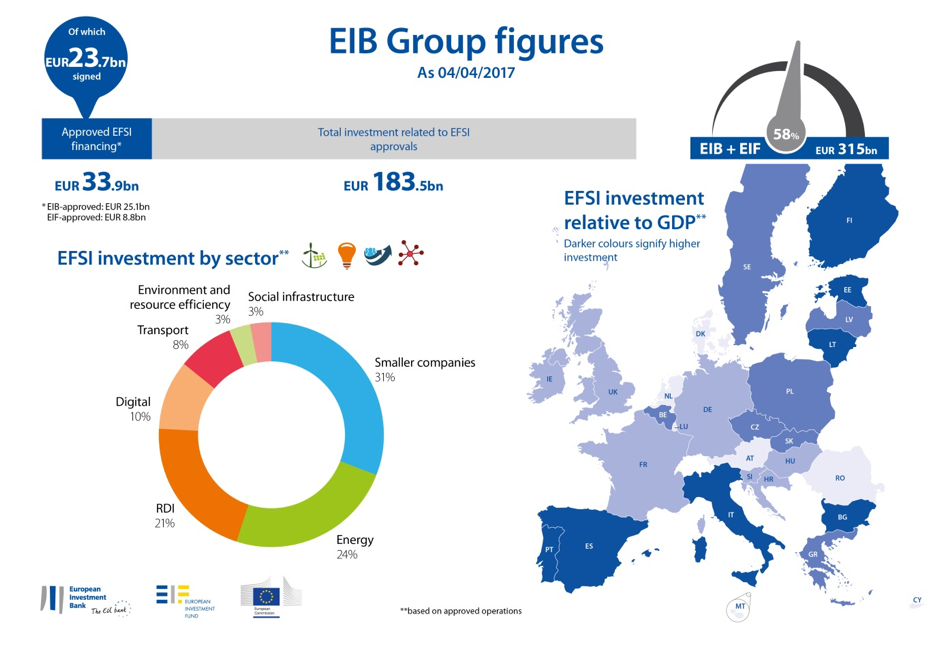

Stančič: While in the European Union there is still lack of investments as a consequence of the financial crisis, there is liquidity on the financial markets and needs to be addressed. There is however no simple answer on how to stimulate growth and new jobs; there is no such way as magic stick that would create them. The European Commission, under its President Juncker, launched immediately after the start of its current mandate in late 2014 an initiative to encourage strategic investments in key economic sectors as well as into innovative and high growth SMEs. This initiative is about attracting back in both public and especially private capital backed by the EU guarantee for taking higher risks. The key element of the Investment Plan for Europe or "Juncker's Plan" is the European Fund for Strategic Investments (EFSI) with already visible results. As of April 2017, EFSI has triggered some 183.5 billion euros of total investments or 58% of its target amount of 315 billion euros in the period 2015-2018.

And how can we summarize the concrete benefits for small and medium-sized companies?

Stančič: For infrastructure projects and financing of SMEs, that are now implemented in all 28 EU Member States, some 33.9 billion euros of EFSI guarantees were approved; out of which the European Investment Bank (EIB) approved some 261 infrastructure projects (with 25.1 billion euros of EFSI guarantees) and the European Investment Fund (EIF) 271 agreements with financial intermediaries for SME financing (backed by 8.8 billion euros of EFSI guarantees). These agreements are to support more than 400,000 SMEs and mid-size companies. As regards the EFSI implementation via the European Investment Fund, financial instruments include both debt- and equity-type of instruments. With equity capital are backed venture capital funds EU-wide so that they would further invest in the European start-ups and innovative high growth SMEs.

How is the EFSI financing for SMEs implemented in Slovenia?

Stančič: EFSI operations are in Slovenia implemented via the Slovenian Enterprise Fund. The EIF and the Slovenian Enterprise Fund signed in November 2015 an agreement to provide 180 million euros of guarantees to SMEs in Slovenia in the period 2016-2018. The guarantees are provided as a result of a counter-guarantee from the EIF under the COSME programme with financial backing from the European Commission. Up to 1,500 SMEs are expected to benefit from this support.

What has been the EIB and EIF's role in implementation of the Investment Plan?

Jacobs: The EIB Group, encompassing both EIB and EIF, has under the Investment Plan for Europe been entrusted with the mandate to deliver on two core objectives, namely, firstly, to mobilize the financial resources instrumental in tackling the investment gap and inducing growth, innovation and job creation in Europe, and, secondly, to advice and support authorities and project promoters on the development of projects as well as on the creation of bespoke local funding solutions. In order to fulfil its dual mandate, EIB has adapted operations and organisation in order to be able to provide adequate and timely responses across the full risk spectrum, i.e. from venture capital or micro finance to more traditional loans. And, as outlined by my European Commission colleague Zoran Stancic before, all is progressing smoothly and proficiently with some 33.9 billion euros EFSI transactions already approved.

How has the EIF as cornerstone investor contributed to development of the VC market in the EU?

Jacobs: The European Investment Fund has now for many years been a leading institution in the European venture capital (VC) market. It has consistently strived for the establishment of a sustainable VC ecosystem in Europe through its support for innovation and entrepreneurship. With its public background, its vocation has been to focus on market imperfections or failures (especially for small investments and/or early stage ventures, elements like the high fixed cost barrier, the asymmetric information reality, the market fragmentation) hindering the development of a vibrant European VC market and enhance the presence and accessibility of alternative funding avenues for SMEs. Most recent estimates on the European VC market, relating to the year 2014, indicate that 45% of overall fundraising volumes was related to VC funds backed by the EIF, which is a substantial increase on 36% for the year 2007 (EIF’s direct participation standing at respectively 12% and 5%). Over its existence, the EIF has been investing in SME equity through more than 500 venture capital and growth equity funds. High due diligence requirements that EIF performs before investing into venture capital funds have valuable catalytic effect on private sector VC co-investors. In addition, EIF's relatively stable commitment to the funds it enters, stimulates first time funds private investors not to shy way.

How does this affect the start-up arena?

Jacobs: Focusing more closely on the start-up arena, the EIF is clearly a leading player with over 50% of all its SME investments in the start-up companies. Over 3,000 start-ups in Europe were already indirectly supported by the EIF. The EIF works with top-tier equity funds which have invested in many successful start-ups. Success stories include companies such as Skype, Spotify, Farfetch, Just Eat and many more.

The equity type of financing for development of innovative companies with high growth potential is also encouraged by the European Commission. Can you please share with us how the EC provides the support and why is this important?

Stančič: The European Commission is with the Investment Plan for Europe on the one hand mobilising investments, including equity type of financing, and on the other hand it is encouraging the Member States to remove the investment barriers. To help improve financing conditions in the EU, the Investment Plan envisages the creation of a Capital Markets Union to reduce fragmentation in the financial markets and increase the supply of capital to businesses and investment projects. Due to the fragmentation of the European venture capital market and different regulatory requirements in the Member States, cross-border investments are limited and this market is not developing as for example in the United States (example of the opportunities that a fully functioning single market for capital could offer: if EU venture capital markets were as deep as the US, as much as 90 billion euros more in funds would have been available to companies between 2008 and 2013). As regards completing the Capital Markets Union, on a proposal of the Commission the Member States and the European Parliament are now amending the EU rules to further facilitate cross-border investments by venture capital funds.

Is the public-private partnership also important in these activities?

The European Commission is under the Investment Plan since November 2016 cooperating with the EIF also in creating a Pan-European venture capital funds-of-funds that aims to unlock market-based finance for SMEs and increase cross-border investments.

How is the European Commission evaluating the area of venture capital financing in Slovenia?

Stančič: The European Commission is analysing development of venture capital markets in the Member States also through the European Semester process. As for Slovenia, one of the 2016 country specific recommendations was to improve access to alternative sources of finance. With the Commission's 2017 Country report for Slovenia progress was analysed as limited only: while there were some new seed capital instruments, among others tax incentives for venture capital companies were abolished as of January 2017 (before such an amendment, the Corporate Income Tax Act stipulated a special 0 % tax rate for venture capital companies, but only if they were established in Slovenia). Equity financing is in Slovenia still lower than in the EU. For further development of the alternative sources of finance, measures to increase cross-border inflows to Slovenia should be stimulated as well as measures to stimulate corporate venture capital investments.

Mr Jacobs, can you share with us any examples of recent equity investments in Slovenia and in the region?

Jacobs: Equity and mezzanine investment levels pursued as regards SMEs (start-ups but also later stage) by EIF and generally through intermediating partners and funds, remain unfortunately quite subdued in Slovenia. At this point we have only 1 Slovenian based fund in our portfolio and through this domestic one and other multi-country funds, we have only made equity investments in 7 Slovenian companies for about 5 million euros. But, as also already mentioned by my European Commission colleague, our reach into the start-up arena is luckily enhanced through a longstanding co-operation with the Slovenian Enterprise Fund. We both consider the Slovenian Enterprise fund as well positioned regarding it's consistent address of structural market gap for start-ups and small investments. In addition, we perceive the Slovenian Enterprise Fund as efficient and effective as evident by its considerably large portfolio of successful investments. But overall, with the EFSI enlarged capacity of the EIF to act across a wide spectrum of activities ( technology transfer support, business angel programs, early stage venture capital, just to mention some), we would be very keen to generate a more intense interaction with the Slovenian market.

Can Slovenian companies turn to foreign venture capital funds backed by the EU?

Stančič: The European Commission is via the European Investment Fund supporting especially those venture capital funds that invest in innovative companies in several EU countries. As regards Slovenian start-ups and high growth companies, they can turn to foreign venture capital funds. Example: equity fund 3TS Capital Partners had been backed by the EU via the European Investment Fund for investments in the CEE region. The 3TS fund thus invested in March 2017 in Slovenian company Parsek and in December 2016 in company Safesize with technology centre in Vrhnika. More information about cross-border venture capital funds backed by the EU is available at webportal http://access2finance.eu/.

#InvestEU useful links

Investment plan for Europe has already supported more than 3,000 startups!

Before this year’s PODIM Conference, we sat down with Zoran Stančič, Head of the European Commission (EC) Representation in Slovenia, and Peter Jacobs, Head of the European Investment Bank (EIB) office in Slovenia. Both institutions (EC and EIB) are together implementing the Investment plan for Europe, and stimulating removal of the investment obstacles in the EU. Since late 2014 the Investment Plan for Europe has brought results and it's on track to achieve its goals of creating 315 billion euros of additional investments in Europe between 2015-2018. The European Fund for Strategic Investments (EFSI) has so far approved 33.9 billion euros of guarantees for more than 200 infrastructure projects and for the benefit of more than 400.000 SMEs and mid-caps. The importance of the “Juncker plan" is also confirmed by the European Investment Fund's indirect support for more than 3,000 startups in Europe, as it is co-investing with leading venture capital funds that have backed many successful startups, including Skype, Spotify, Farfetch, Just Eat, and many others.

- - -

Before last year's PODIM Conference we spoke about the goals and project of the European Investment Plan in financing SMEs and start-ups. What are the results of the program in Slovenia and the EU so far?

Stančič: While in the European Union there is still lack of investments as a consequence of the financial crisis, there is liquidity on the financial markets and needs to be addressed. There is however no simple answer on how to stimulate growth and new jobs; there is no such way as magic stick that would create them. The European Commission, under its President Juncker, launched immediately after the start of its current mandate in late 2014 an initiative to encourage strategic investments in key economic sectors as well as into innovative and high growth SMEs. This initiative is about attracting back in both public and especially private capital backed by the EU guarantee for taking higher risks. The key element of the Investment Plan for Europe or "Juncker's Plan" is the European Fund for Strategic Investments (EFSI) with already visible results. As of April 2017, EFSI has triggered some 183.5 billion euros of total investments or 58% of its target amount of 315 billion euros in the period 2015-2018.

And how can we summarize the concrete benefits for small and medium-sized companies?

Stančič: For infrastructure projects and financing of SMEs, that are now implemented in all 28 EU Member States, some 33.9 billion euros of EFSI guarantees were approved; out of which the European Investment Bank (EIB) approved some 261 infrastructure projects (with 25.1 billion euros of EFSI guarantees) and the European Investment Fund (EIF) 271 agreements with financial intermediaries for SME financing (backed by 8.8 billion euros of EFSI guarantees). These agreements are to support more than 400,000 SMEs and mid-size companies. As regards the EFSI implementation via the European Investment Fund, financial instruments include both debt- and equity-type of instruments. With equity capital are backed venture capital funds EU-wide so that they would further invest in the European start-ups and innovative high growth SMEs.

How is the EFSI financing for SMEs implemented in Slovenia?

Stančič: EFSI operations are in Slovenia implemented via the Slovenian Enterprise Fund. The EIF and the Slovenian Enterprise Fund signed in November 2015 an agreement to provide 180 million euros of guarantees to SMEs in Slovenia in the period 2016-2018. The guarantees are provided as a result of a counter-guarantee from the EIF under the COSME programme with financial backing from the European Commission. Up to 1,500 SMEs are expected to benefit from this support.

What has been the EIB and EIF's role in implementation of the Investment Plan?

Jacobs: The EIB Group, encompassing both EIB and EIF, has under the Investment Plan for Europe been entrusted with the mandate to deliver on two core objectives, namely, firstly, to mobilize the financial resources instrumental in tackling the investment gap and inducing growth, innovation and job creation in Europe, and, secondly, to advice and support authorities and project promoters on the development of projects as well as on the creation of bespoke local funding solutions. In order to fulfil its dual mandate, EIB has adapted operations and organisation in order to be able to provide adequate and timely responses across the full risk spectrum, i.e. from venture capital or micro finance to more traditional loans. And, as outlined by my European Commission colleague Zoran Stancic before, all is progressing smoothly and proficiently with some 33.9 billion euros EFSI transactions already approved.

How has the EIF as cornerstone investor contributed to development of the VC market in the EU?

Jacobs: The European Investment Fund has now for many years been a leading institution in the European venture capital (VC) market. It has consistently strived for the establishment of a sustainable VC ecosystem in Europe through its support for innovation and entrepreneurship. With its public background, its vocation has been to focus on market imperfections or failures (especially for small investments and/or early stage ventures, elements like the high fixed cost barrier, the asymmetric information reality, the market fragmentation) hindering the development of a vibrant European VC market and enhance the presence and accessibility of alternative funding avenues for SMEs. Most recent estimates on the European VC market, relating to the year 2014, indicate that 45% of overall fundraising volumes was related to VC funds backed by the EIF, which is a substantial increase on 36% for the year 2007 (EIF’s direct participation standing at respectively 12% and 5%). Over its existence, the EIF has been investing in SME equity through more than 500 venture capital and growth equity funds. High due diligence requirements that EIF performs before investing into venture capital funds have valuable catalytic effect on private sector VC co-investors. In addition, EIF's relatively stable commitment to the funds it enters, stimulates first time funds private investors not to shy way.

How does this affect the start-up arena?

Jacobs: Focusing more closely on the start-up arena, the EIF is clearly a leading player with over 50% of all its SME investments in the start-up companies. Over 3,000 start-ups in Europe were already indirectly supported by the EIF. The EIF works with top-tier equity funds which have invested in many successful start-ups. Success stories include companies such as Skype, Spotify, Farfetch, Just Eat and many more.

The equity type of financing for development of innovative companies with high growth potential is also encouraged by the European Commission. Can you please share with us how the EC provides the support and why is this important?

Stančič: The European Commission is with the Investment Plan for Europe on the one hand mobilising investments, including equity type of financing, and on the other hand it is encouraging the Member States to remove the investment barriers. To help improve financing conditions in the EU, the Investment Plan envisages the creation of a Capital Markets Union to reduce fragmentation in the financial markets and increase the supply of capital to businesses and investment projects. Due to the fragmentation of the European venture capital market and different regulatory requirements in the Member States, cross-border investments are limited and this market is not developing as for example in the United States (example of the opportunities that a fully functioning single market for capital could offer: if EU venture capital markets were as deep as the US, as much as 90 billion euros more in funds would have been available to companies between 2008 and 2013). As regards completing the Capital Markets Union, on a proposal of the Commission the Member States and the European Parliament are now amending the EU rules to further facilitate cross-border investments by venture capital funds.

Is the public-private partnership also important in these activities?

The European Commission is under the Investment Plan since November 2016 cooperating with the EIF also in creating a Pan-European venture capital funds-of-funds that aims to unlock market-based finance for SMEs and increase cross-border investments.

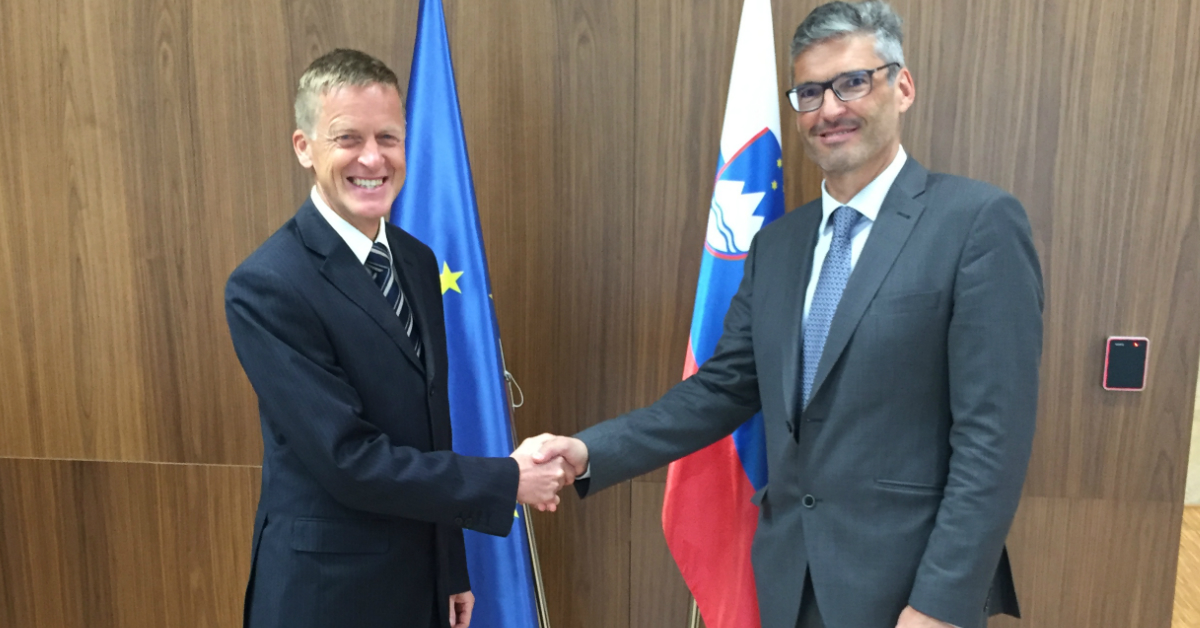

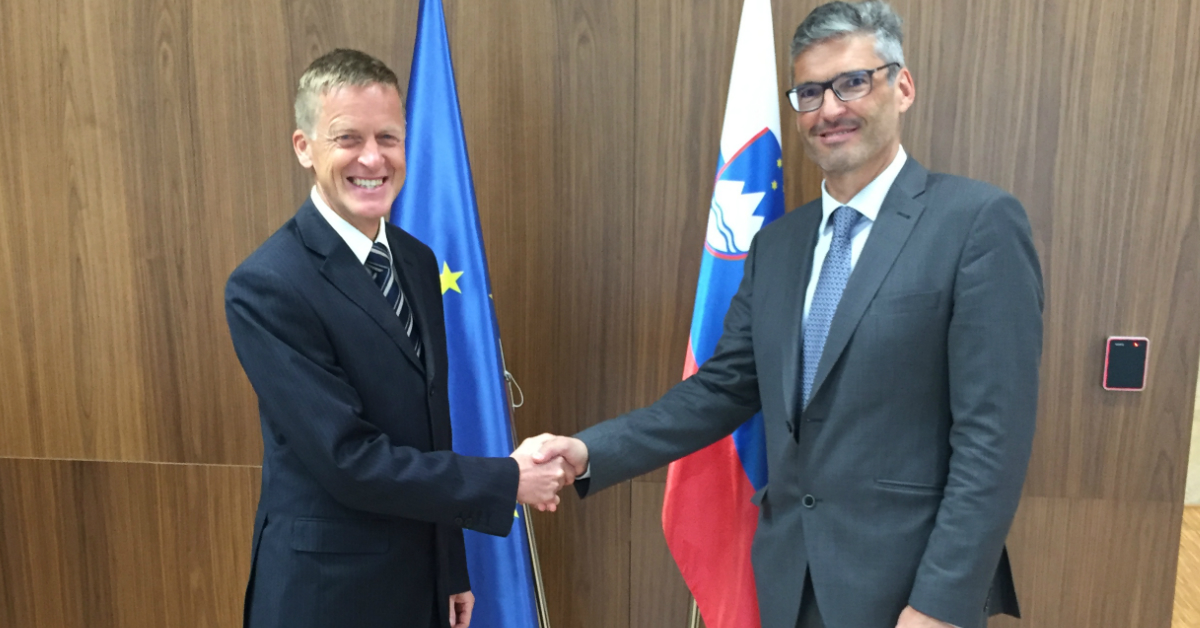

Photo: Peter Jacobs (left), Head of the European Investment Bank office in Slovenia, and Zoran Stančič, Head of the European Commission Representation in Slovenia

How is the European Commission evaluating the area of venture capital financing in Slovenia?

Stančič: The European Commission is analysing development of venture capital markets in the Member States also through the European Semester process. As for Slovenia, one of the 2016 country specific recommendations was to improve access to alternative sources of finance. With the Commission's 2017 Country report for Slovenia progress was analysed as limited only: while there were some new seed capital instruments, among others tax incentives for venture capital companies were abolished as of January 2017 (before such an amendment, the Corporate Income Tax Act stipulated a special 0 % tax rate for venture capital companies, but only if they were established in Slovenia). Equity financing is in Slovenia still lower than in the EU. For further development of the alternative sources of finance, measures to increase cross-border inflows to Slovenia should be stimulated as well as measures to stimulate corporate venture capital investments.

Mr Jacobs, can you share with us any examples of recent equity investments in Slovenia and in the region?

Jacobs: Equity and mezzanine investment levels pursued as regards SMEs (start-ups but also later stage) by EIF and generally through intermediating partners and funds, remain unfortunately quite subdued in Slovenia. At this point we have only 1 Slovenian based fund in our portfolio and through this domestic one and other multi-country funds, we have only made equity investments in 7 Slovenian companies for about 5 million euros. But, as also already mentioned by my European Commission colleague, our reach into the start-up arena is luckily enhanced through a longstanding co-operation with the Slovenian Enterprise Fund. We both consider the Slovenian Enterprise fund as well positioned regarding it's consistent address of structural market gap for start-ups and small investments. In addition, we perceive the Slovenian Enterprise Fund as efficient and effective as evident by its considerably large portfolio of successful investments. But overall, with the EFSI enlarged capacity of the EIF to act across a wide spectrum of activities ( technology transfer support, business angel programs, early stage venture capital, just to mention some), we would be very keen to generate a more intense interaction with the Slovenian market.

Can Slovenian companies turn to foreign venture capital funds backed by the EU?

Stančič: The European Commission is via the European Investment Fund supporting especially those venture capital funds that invest in innovative companies in several EU countries. As regards Slovenian start-ups and high growth companies, they can turn to foreign venture capital funds. Example: equity fund 3TS Capital Partners had been backed by the EU via the European Investment Fund for investments in the CEE region. The 3TS fund thus invested in March 2017 in Slovenian company Parsek and in December 2016 in company Safesize with technology centre in Vrhnika. More information about cross-border venture capital funds backed by the EU is available at webportal http://access2finance.eu/.

#InvestEU useful links

- The Investment Plan for Europe: http://ec.europa.eu/invest-eu

- European Investment Bank (EIB in EFSI): http://eib.europa.eu/efsi

- European Investment Fund (EIF): http://eif.europa.eu

- European Investment Project Portal (EIPP): http://ec.europa.eu/eipp

- European Investment Advisory Hub (EIAH): http://eib.europa.eu/eiah

- Portal about cross-border venture capital funds backed by the EU: http://access2finance.eu/

- Slovene Enterprise Fund: http://www.podjetniskisklad.si